|

|

Delegated control without the risk or ops team

Pylon delivers autonomous mortgages from app to settlement, replacing manual operations with software. Get delegated-level control and margin without correspondent complexity and cost.

Why non-del correspondents are switching to Pylon

Automate the full mortgage lifecycle and eliminate manual work and stitched-together tech stacks

Eliminate underwriting delays with always-on automation that delivers instant, programmatic loan decisions

Access whole loan desks, more loan products, and multiple takeout paths without investor approvals or risk

Replace fixed operating costs with a variable model that boosts margins and scales in any market

|

|

Programmatic mortgage origination: a new model for lenders

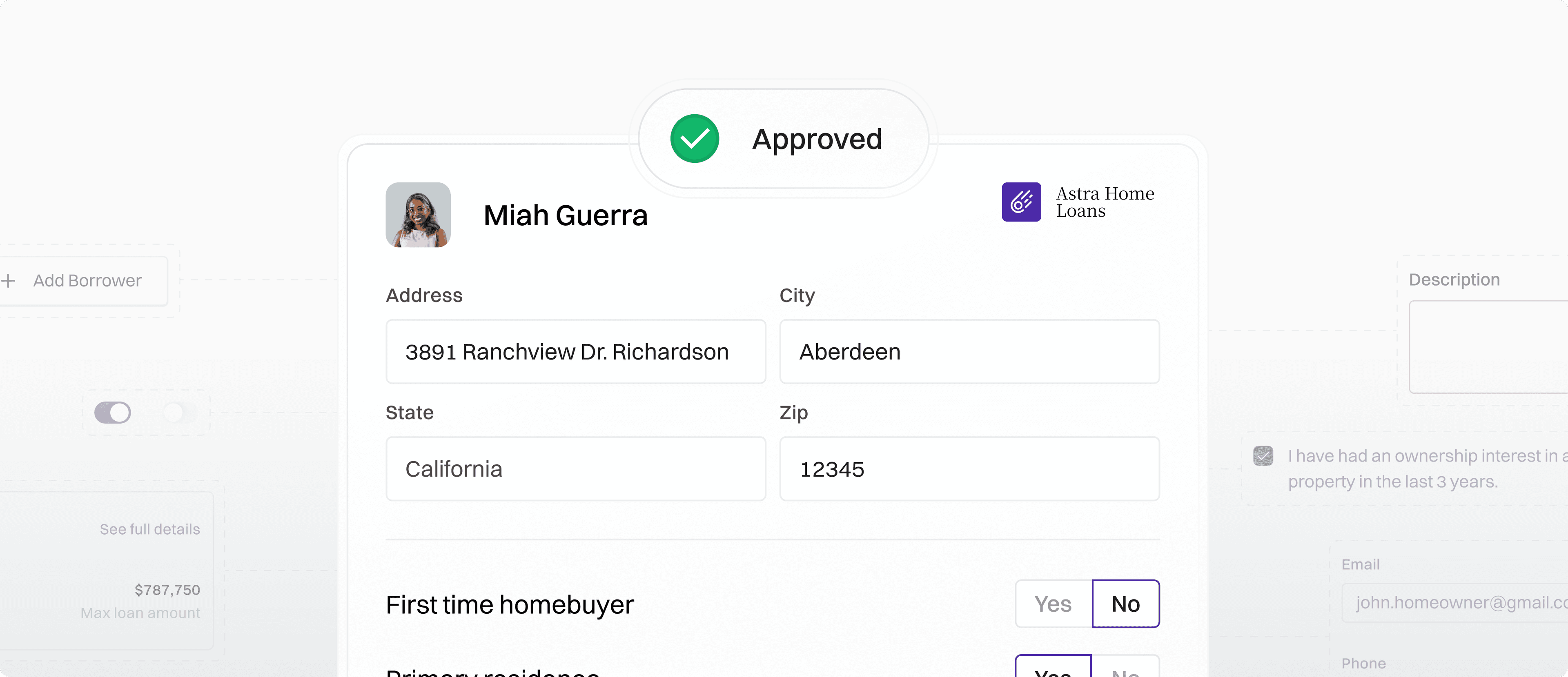

Autonomous mortgages: replace your ops team with software

From app to settlement, Pylon runs the entire mortgage process on code. Cut manual overhead, increase margin, and scale effortlessly.

Elevate your borrower offering

Break free from rigid POS borrower flows. Launch fast with prebuilt Elements or fully customize on Pylon’s APIs, with bare metal rates from our institutional takeout investor network.

Get direct access to whole loan desks and pricing paths usually gated behind delegated approvals.

Pylon underwrites and monitors every file so you stay insulated from credit risk, repurchase exposure, and delegated liability.

With Command Center and always-on automation, your LOs spend less time chasing documents and more time building relationships that win deals.

Traditional loan structuring relies on guesswork. Pylon instantly evaluates every possible loan scenario, helping LOs close faster and deliver better outcomes.

Your current stack is failing you

Manual workflows, slow underwriting, and an under-optimized capital stack make it difficult to price competitively or move with speed. The result:

Pylon vs. the current model

Pylon replaces fragmented partner stacks, legacy software, and your manual operations team with one fully integrated, software-driven platform.

|

|

Go live in days, or build custom

Pylon works out of the box or can be tailored to your workflow. Launch without an engineer or integrate deeply via API.

|

|

|

|

|

|

From application to settlement in one unified platform

Everything you need to originate with confidence: automated credit decisioning, built-in compliance, direct capital access, and intelligent structuring tools.

Intelligent credit evaluations

Direct access to bare metal rates

Modern support tooling for LOs

Automated, always-on compliance

Deliver pixel-perfect origination experiences

*Pylon assumes all reps and warrants and repurchase risk on loans it delivers, excluding cases of fraud, misrepresentation, or noncompliance originating from the lender.