August 2025 Product Release

This month’s updates include a new Jumbo takeout, streamlined tasking, loan progress notifications, and shareable pricing scenarios

These features deliver better pricing, more control, improved collaboration, and faster, more accurate loan origination.

Better jumbo pricing via new institutional takeout

We’ve onboarded a new, top institutional takeout (to be announced) to Pylon Capital, expanding your takeout options for Jumbo 30-year fixed and ARM products with direct API access and full visibility in Command Center.

What it means for you:

- Better rates with more competitive takeouts

- More execution confidence even in volatile markets

- Expanded product support for both fixed-rate and ARM Jumbo scenarios

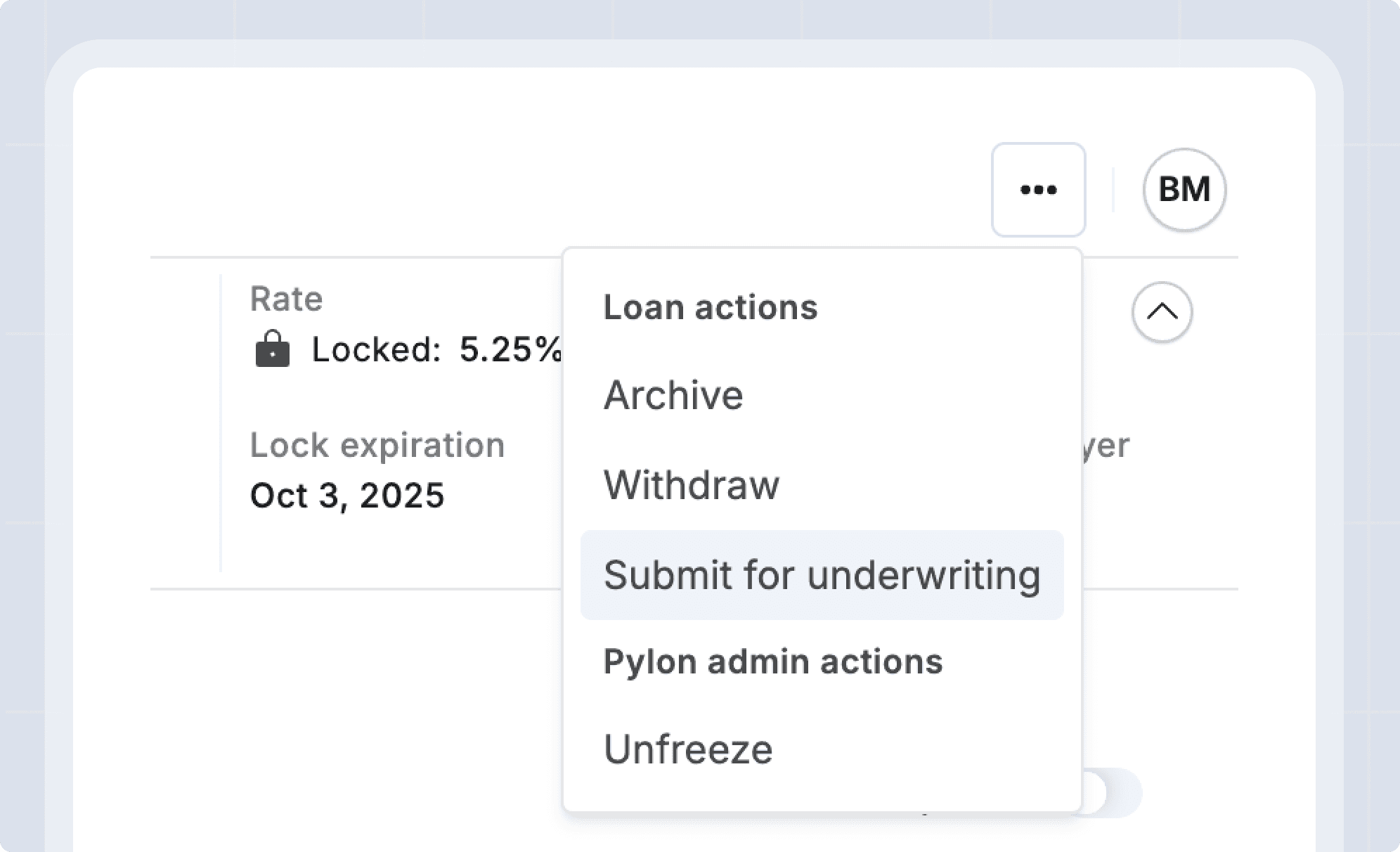

Streamlined tasking with greater LO control

Loan officers can now review borrower uploads, mark them incomplete if needed, add context and additional documents, and control when files are submitted to underwriting. Additionally, LOs now manage key order outs, can customize task presentation, and control condition routing.

What it means for you:

- Greater control over task workflows

- More accurate files and faster approvals

- Clearer borrower communication

Loan progress notifications

LOs now receive email notifications of loan stage changes with deep links to the specific file in the Command Center. Notifications are also available via API.

What it means for you:

- Proactive loan stage updates

- On-the-go status visibility

- Faster borrower follow-ups

Shareable pricing scenarios

You can now share exact pricing scenarios with your team by copying and sending the Command Center page URL. As fields are adjusted, the link updates automatically so teammates can open and view the same scenario in real time.

What it means for you:

- Share scenarios with teammates instantly

- Eliminate errors with a single source of truth

- Make decisions faster

API improvements

We’ve continued to enhance Pylon’s API to improve speed, accuracy, and transparency across the loan lifecycle.

Closing cost estimates are now more accurate, driving downstream improvements in loan structuring (also in Command Center).

The pricing engine now defaults to using the full out-of-pocket maximum unless a better borrower outcome is available.

Document queries are now faster and more reliable, improving overall API performance.