July 2025 Product Release

This month’s updates bring transparency and automation to order outs, faster workflows with centralized contacts management, and streamlined document management.

Each upgrade is built to save time, reduce manual work, and ensure loans move with clarity.

Order outs visibility for appraisal and title

Tracking appraisal and title order outs is now fully transparent and automated, available via API and Command Center, with a new summary table on the Product & Pricing tab and an activity log that captures the full lifecycle of each order out, updated programmatically.

What it means for you:

- Real-time transparency into appraisal and title order outs

- Easy access to statuses, contacts, and related documents

- Full lifecycle tracking with automated updates

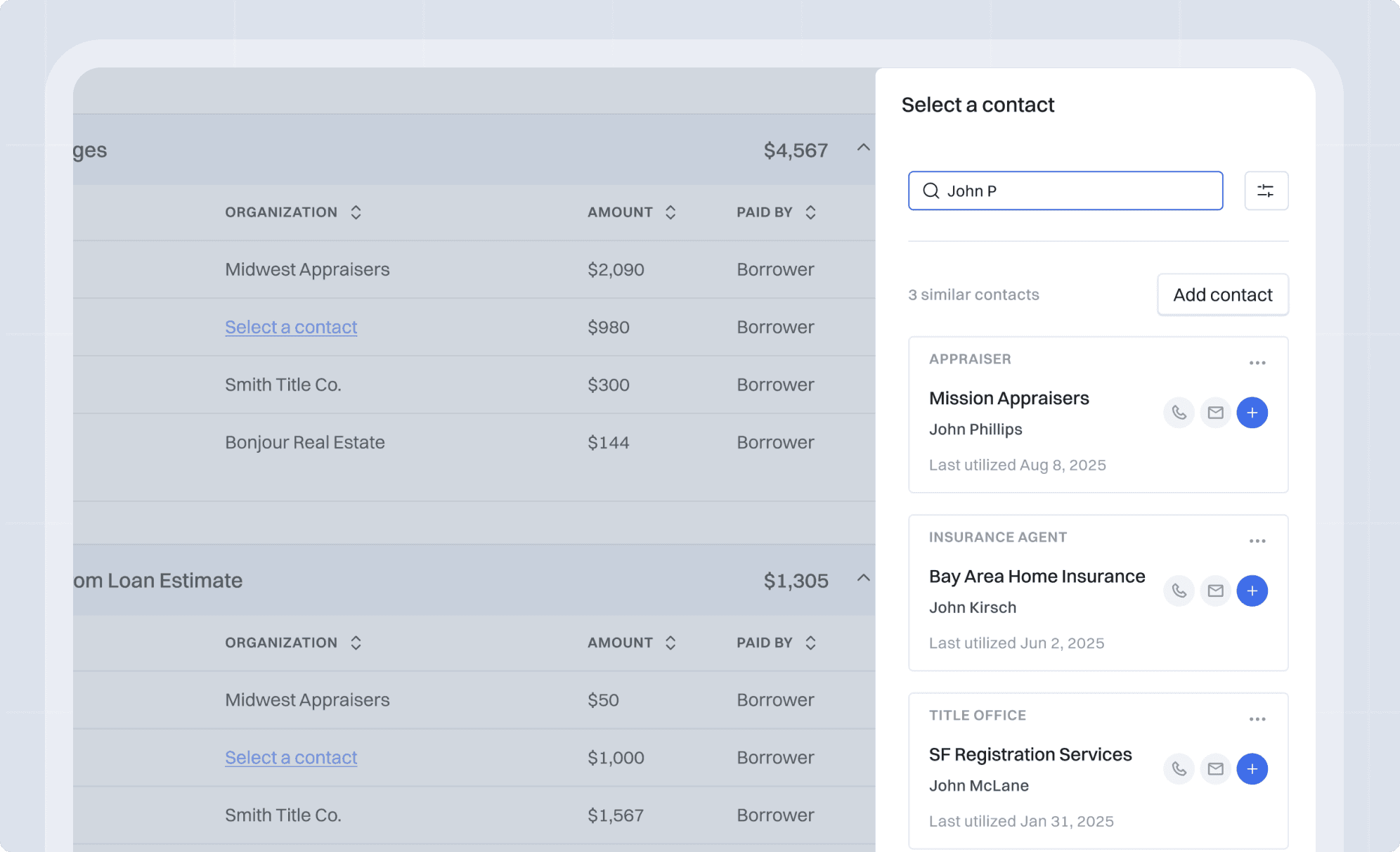

Contacts management for faster loan workflows

You can now add, edit, remove, and view loan contacts directly on each file via API and in the Command Center. A built-in contact book makes it easy to reuse contacts across loans. Search and filter tools make it simple to manage large contact lists, and contacts now automatically flow into disclosures.

What it means for you:

- Centralized contact management

- Streamlined workflows with reusable, auto-populating contact data

- Easy search and filtering for large contact lists

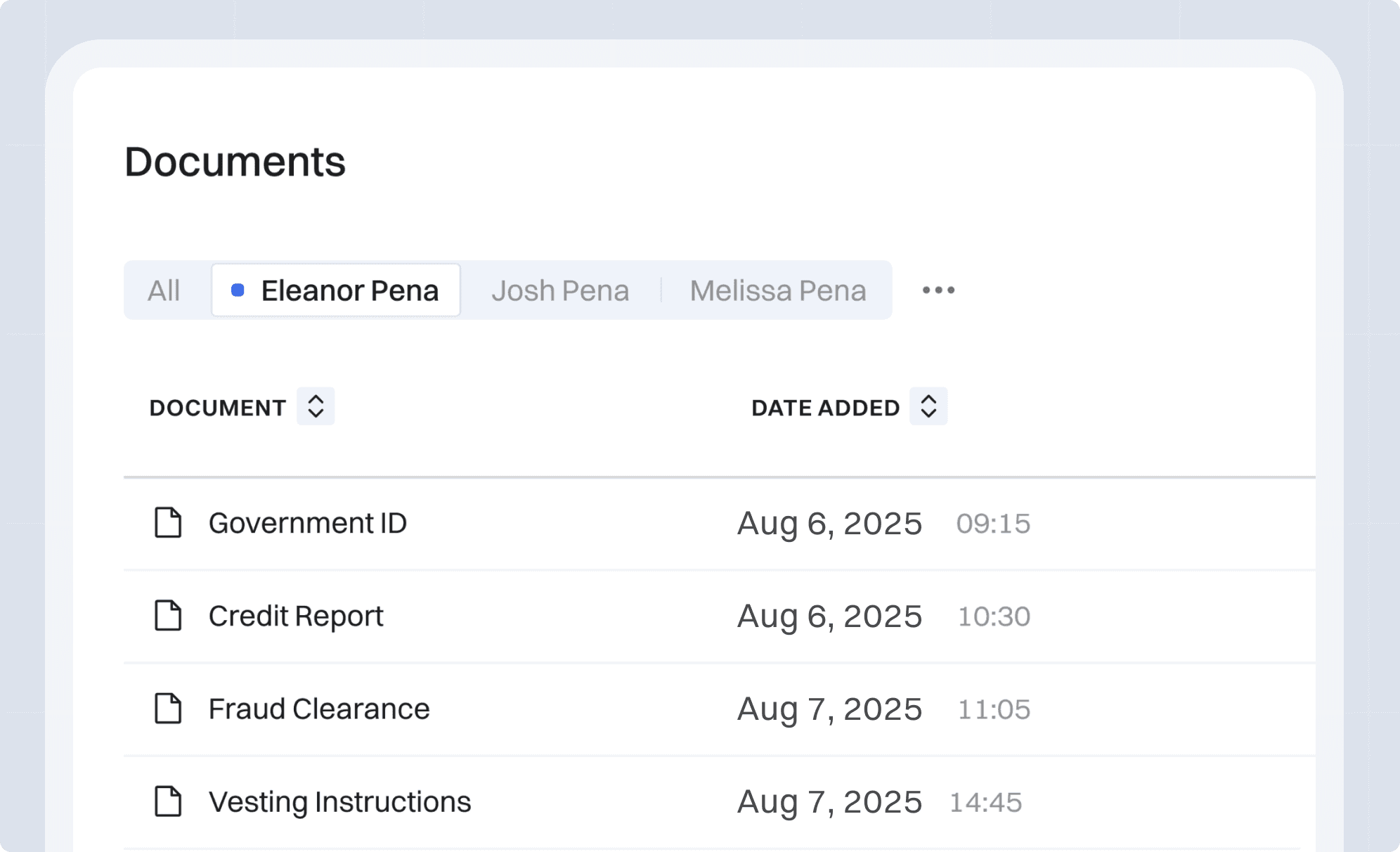

Streamlined documents management

Loan files now include a Documents tab (Command Center and via API) that shows all system- and borrower-uploaded documents in one place. Loan officers can search and filter across documents, making it faster and easier to find exactly what they need at any stage of the loan.

What it means for you:

- One place to view all loan documents

- Faster access with search and filtering tools

- Greater efficiency throughout the loan lifecycle

API improvements

We’ve continued to enhance Pylon’s API to give originators more visibility, flexibility, and control across the loan lifecycle.

You can now track borrower engagement with disclosures through a new “Viewed On” field, complementing the existing “Sent” status and providing a clearer timeline.

We’ve also introduced API-based documents and contacts management, centralizing file handling and reducing manual work. Appraisal documents are now accessible directly from the appraisal object in API, making it faster to retrieve and share the files you need.

Lastly, you can now select from multiple rate lock durations and request pricing for specific lock terms directly via API, giving you more control over the lock process.

More news from Pylon