May 2025 Product Release

This month’s updates deliver sharper execution, smoother borrower flows, and better tools for your team. From expanded Jumbo takeouts to soft credit pulls, we’re continuing to advance what modern mortgage software and infrastructure should do. With improvements across disclosures and borrower eligibility, Pylon is helping originators unlock the full potential of mortgage automation.

Better jumbo pricing via new takeout

We’ve onboarded a new Wall Street trading desk (to be announced) to Pylon Capital, expanding your jumbo takeout options with direct API access and full visibility in Command Center.

What it means for you:

- Better rates with more competitive takeouts

- More execution confidence even in volatile markets

- Programmatic access to premier desks without the overhead

Learn more about how we power Capital »

Frictionless pre-approvals with soft credit pulls

We’ve added soft credit pulls to the borrower pre-approval flow, now available via API, Elements, and Command Center.

Borrowers can get pre-approved without impacting their credit scores and without triggering lead resellers. A hard pull only happens once the loan moves into underwriting, making the experience smoother, safer, and more borrower-friendly from the start.

What it means for you:

- Faster pre-approvals with less upfront friction

- No credit score impact during early rate shopping

- A privacy-first experience that builds borrower trust

See how Elements powers custom borrower experiences »

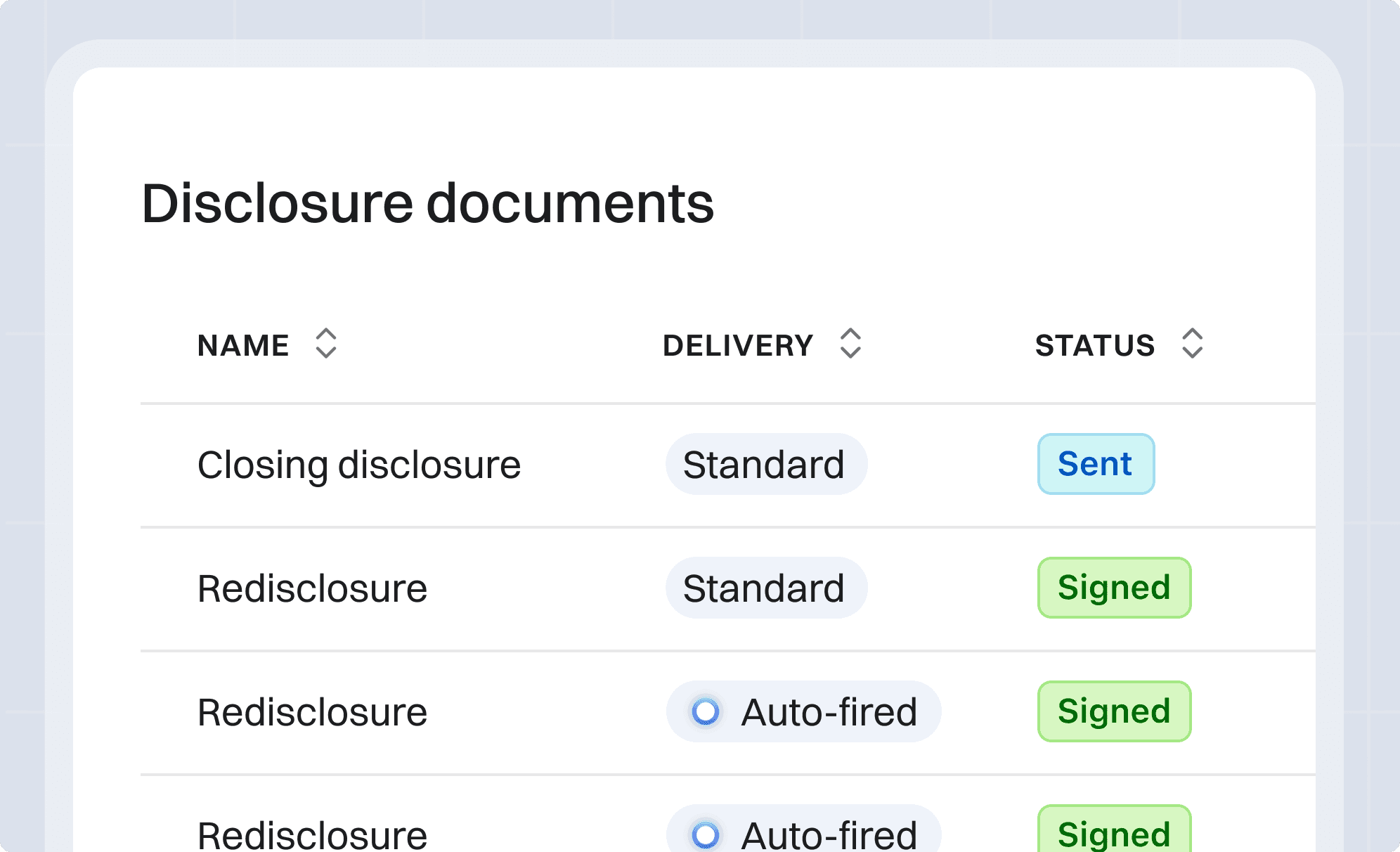

Streamlined disclosure access in Command Center

We’ve upgraded the disclosure experience with more consistent document access, better visibility, and a fully integrated workflow in Command Center.

Loan officers can now view and sign disclosures directly in one place without digging through email. Tooltips have been refreshed with interactive content to make it easier to see what’s been sent, when, and to whom.

What it means for you:

- One-click access to all borrower disclosures

- No more email digging or manual document tracking

- A cleaner, faster experience for every loan officer

Learn more about Command Center »

More access for borrowers with expanded DTI

Pylon now supports Fannie Mae’s updated debt-to-income guidelines, increasing the maximum allowable DTI from 45% to 50% for conventional loans.

This update gives originators the ability to qualify more borrowers, including those with higher monthly debt, lower incomes, or smaller down payments.

What it means for you:

- More approvals for borrowers who previously fell short

- Greater flexibility in qualifying conventional loans

- Stronger reach across a wider range of borrower profiles

API improvements

We’ve continued to enhance Pylon’s API to support more accurate pricing, smarter borrower data handling, and better control for originators. Pricing scenarios now factor in all available out-of-pocket assets, improving accuracy on purchase loans while ensuring closing costs stay within allowable limits.

We added a new APOR (Average Prime Offer Rate) endpoint so that you can compare how our pricing looks relative to the average rate in the market. Additionally, you’re able to query for the APOR on a historical date to know how rates have trended over time

In addition, the API now supports borrower marital status updates via GraphQL, along with expanded handling of military service data, including the ability to query, update, reset, and indicate surviving spouse status. Spouse indicators are now handled more reliably across borrower updates, improving consistency throughout the loan file.